I not too long ago printed a column at Politico on the potential pitfalls with utilizing tariffs to assist American reindustrialization. Test it out!

The final mile is the toughest in spite of everything.

U.S. inflation was about 8% a 12 months in 2021H2-2022H1, up from lower than 2% a 12 months instantly earlier than the pandemic. By December 2024, the U.S. Shopper Worth Index (CPI) was up simply 2.9% over the earlier 12 months, whereas the 12-month change within the Private Consumption Expenditure (PCE) worth index most popular by Federal Reserve officers is probably going going to return in round 2.5%. This enchancment occurred with none significant slowdown in spending, a lot much less the sort of job market downturn that some feared could be needed.

However there may be much less to this than meets the attention, and inflation stays about 1 share level sooner than earlier than the pandemic at a yearly fee. Worse, there are causes to suppose that the comparatively benign circumstances of the previous few years might reverse even with out any disruptive coverage modifications within the U.S. Specifically, if Chinese language policymakers achieve getting their financial system out of its funk, American policymakers might face a severe problem in bringing inflation again to focus on.

Many of the further inflation within the U.S. and different wealthy nations was successfully a coverage alternative to reduce the monetary and financial injury from short-term disruptions to manufacturing, distribution, and shopper preferences attributable to the pandemic and, to a lesser extent, Russia’s warfare on Ukraine. Unsurprisingly, the inflationary impulse from the one-off coverage response dissipated as circumstances normalized. As early as 2022H2, inflation had already slowed to ~3% annualized.

The large query was at all times going to be: the place would inflation settle as soon as the disaster was over?

Many anticipated that the pre-pandemic world would return, with comparable charges of inflation, spending progress, and rates of interest. Others thought that the pandemic and the coverage response altered the basics a lot that the post-pandemic world must be meaningfully totally different from what got here earlier than. From this angle, it was useful to think about the 2020s as considerably analogous to the Nineteen Forties. To date, the proof appears to assist this latter interpretation.

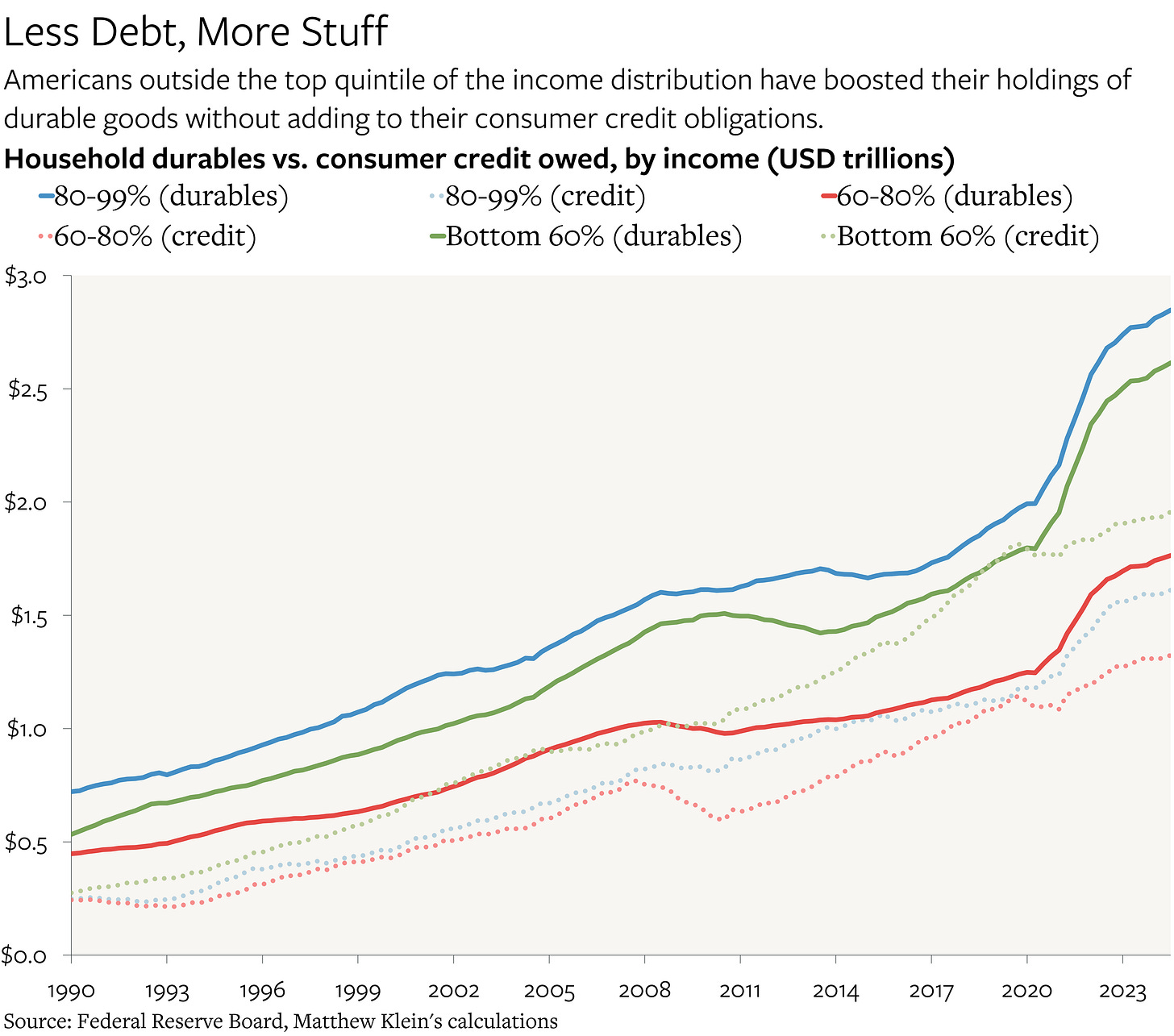

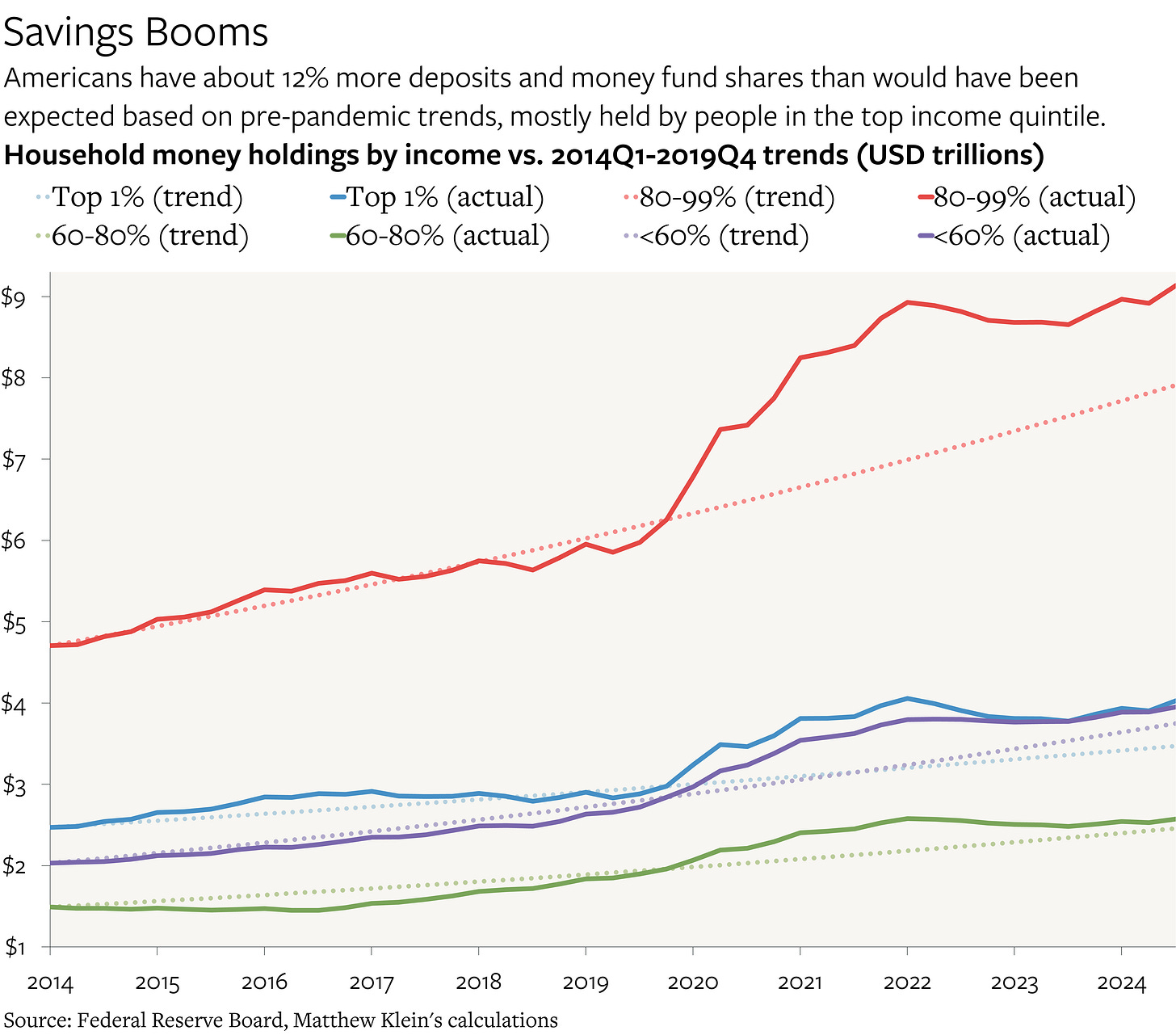

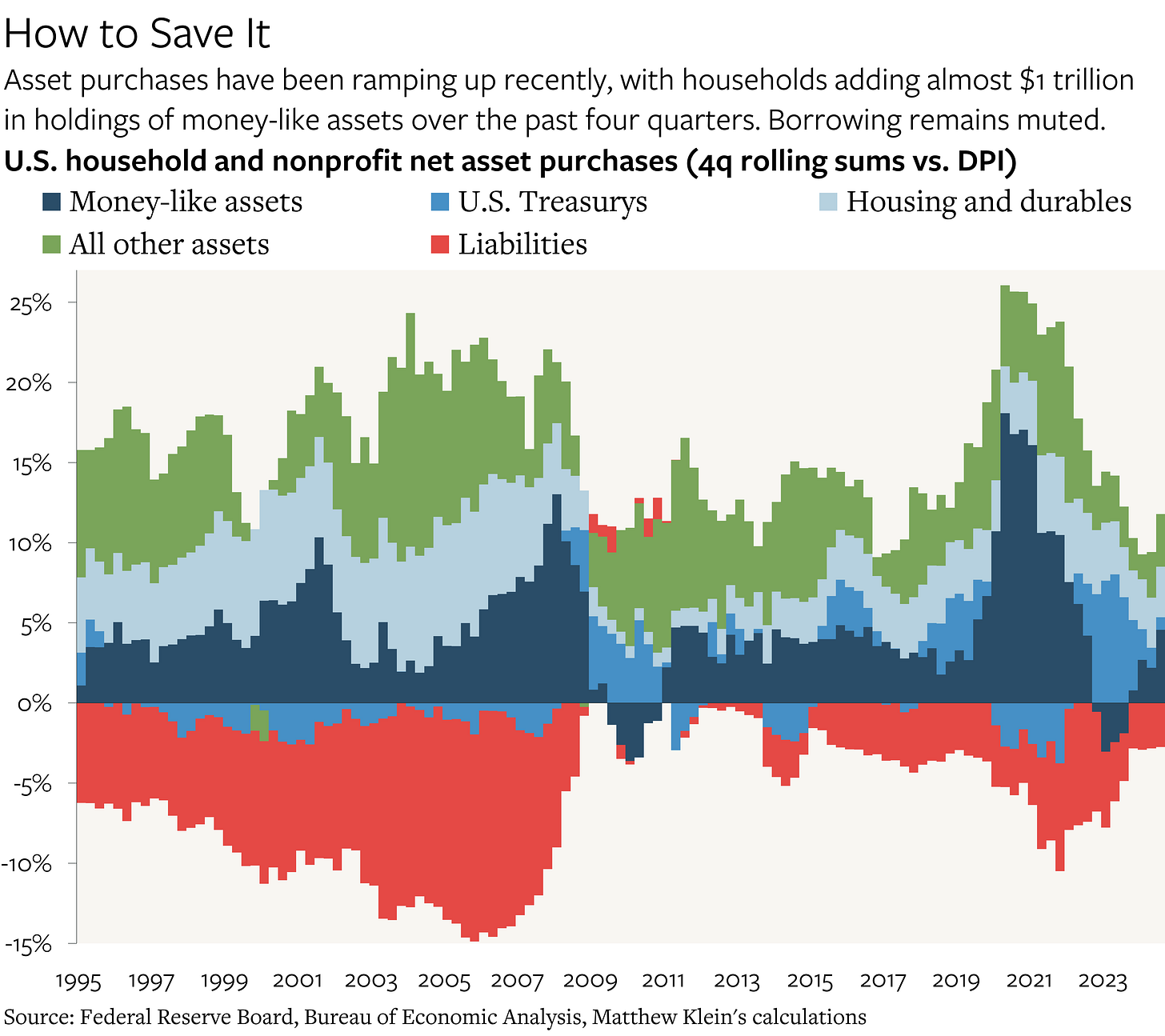

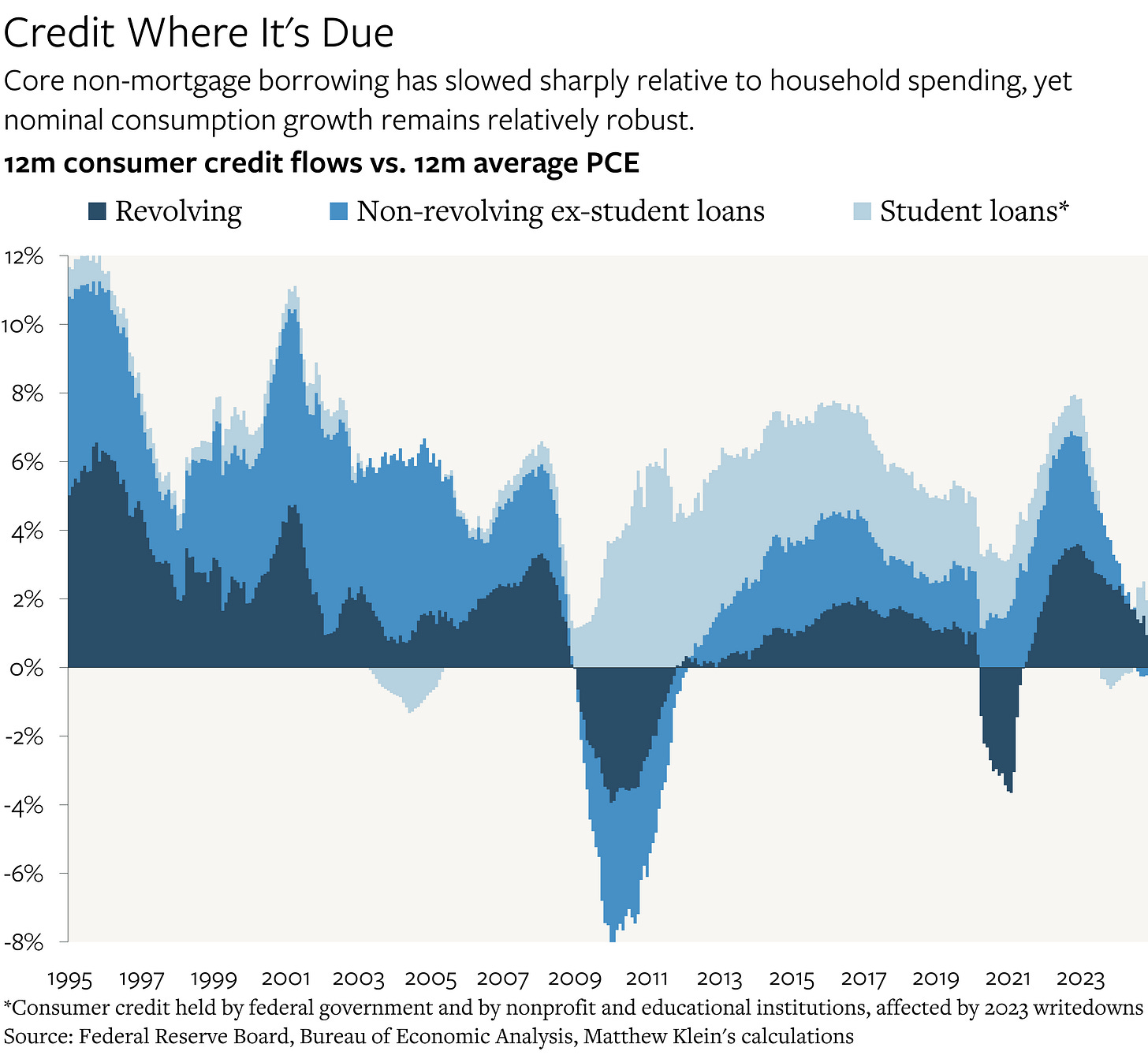

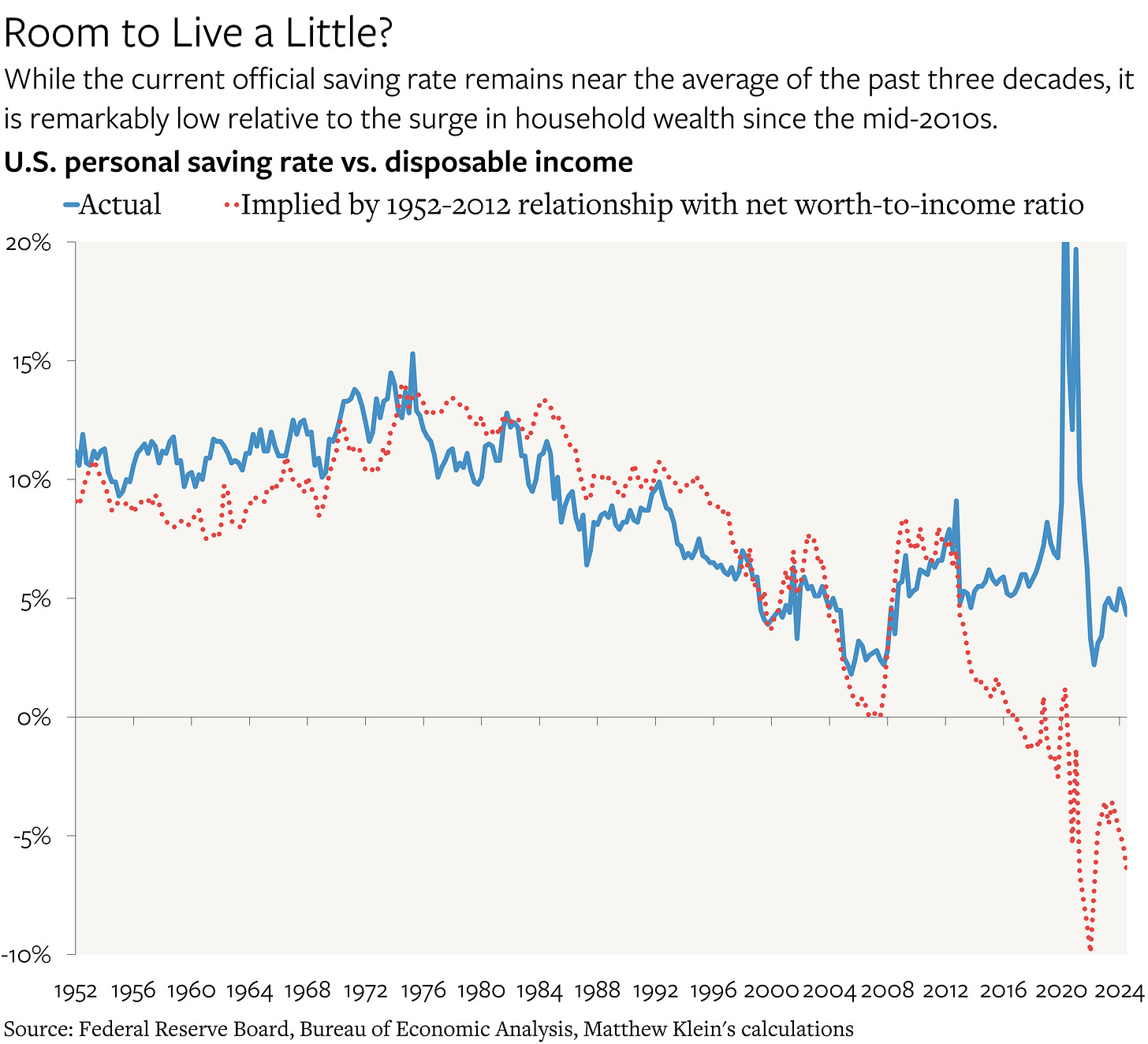

Family steadiness sheets that had been impaired ever because the monetary disaster have been all of the sudden infused with money, permitting richer shoppers to build up liquid belongings as poorer ones stocked up on durables and housing with out growing their indebtedness.

Collectively, these elements made shoppers much less delicate to modifications in monetary circumstances than they have been earlier than. That in flip helps clarify why greater rates of interest didn’t hit the actual financial system as a lot as feared, in addition to why inflation has remained sooner than earlier than the pandemic for much longer than many had anticipated. The flip aspect is that People’ large untapped borrowing capability might probably be unleashed if rates of interest fell sufficient.

With this context, the soundness in most of the inflation numbers over the previous couple of years makes extra sense.